Understanding GSA Pricing: A Complete Guide for Federal Contractors

GSA pricing can seem complex at first glance, but it’s a critical concept for any business looking to sell to the federal government. This guide breaks down what GSA pricing is, how it works, and why it matters for your contracting success.

Key Takeaways:

- GSA pricing refers to the pre-negotiated rates that approved vendors can offer to federal agencies through the GSA Multiple Award Schedule program

- These prices must be fair, reasonable, and typically equal to or better than those offered to your most favored commercial customers

- GSA pricing requires ongoing compliance management, including regular reporting and potential price adjustments

- Strategic pricing decisions can significantly impact your competitiveness and profitability in the federal marketplace

What is GSA Pricing?

GSA pricing refers to the pre-negotiated rates that vendors establish with the General Services Administration (GSA) when awarded a Multiple Award Schedule (MAS) contract. These prices represent what federal agencies can expect to pay when purchasing products or services through your GSA Schedule.

Unlike traditional commercial pricing, GSA pricing undergoes a rigorous review process to ensure the government receives fair and reasonable rates. Once approved, these prices become the ceiling prices for your offerings – meaning you can offer lower prices to agencies during the quoting process, but cannot exceed your established GSA rates.

The primary benefit of GSA pricing is that it streamlines the procurement process. Federal buyers can purchase directly from GSA Schedule holders without going through lengthy competitive bidding procedures, knowing they’re already getting pre-vetted, fair market rates.

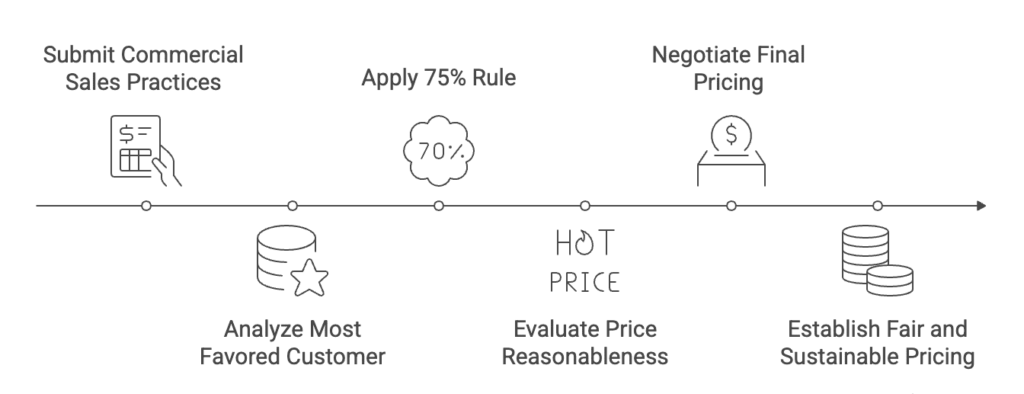

How GSA Pricing Is Determined

The GSA pricing determination process involves several key components:

Commercial Sales Practices (CSP)

During your GSA Schedule application, you’ll submit detailed information about your commercial pricing practices. This includes your standard price lists, discount structures, and special pricing arrangements with various customer categories.

Most Favored Customer (MFC) Analysis

The GSA identifies which of your customer categories receives your best pricing and terms. Your GSA pricing is typically expected to be equal to or better than what you offer your MFC, though exceptions can be negotiated based on differences in quantities, terms, or conditions.

Price Reasonableness Evaluation

GSA Contracting Officers analyze your proposed pricing against:

- Your commercial pricing practices

- Prices offered by other GSA Schedule holders for similar items

- Market research data

- Historical pricing information

Negotiation Process

Based on this analysis, the Contracting Officer will negotiate your final GSA pricing. This often involves discussions about appropriate discount levels from your commercial pricing.

The goal is to establish pricing that’s both fair to the government and sustainable for your business over the potential 20-year contract term.

Negotiations tend to slow down when pricing explanations are vague. They tend to move forward when the pricing story is simple: who gets discounts, when they apply, and why government pricing is structured the way it is. Clear explanations often matter more than aggressive discounting. – Michael Perch, CEO of Road Map Consulting.

GSA Pricing Structures

GSA allows several pricing structures to accommodate different business models:

- Fixed Pricing: The most common approach, where specific prices are established for each product or service offered. These remain constant until formally modified.

- Volume Discounts: Tiered pricing based on quantity purchased, encouraging larger orders from agencies.

- Prompt Payment Discounts: Additional discounts for agencies that pay invoices quickly (typically within 10–30 days).

- Economic Price Adjustment (EPA) Clauses: Mechanisms that allow for periodic price adjustments based on factors like inflation, material costs, or labor rates.

Service Pricing vs. Product Pricing

- Products typically have straightforward unit pricing

- Services may use hourly rates, fixed project fees, or blended rates based on labor categories and experience levels

Transactional Data Reporting (TDR)

Some Schedule holders participate in the TDR pilot program, which requires monthly reporting of actual sales transaction data but eliminates the need for Commercial Sales Practices disclosures and monitoring of the Price Reduction Clause. This can provide more pricing flexibility but requires diligent reporting of detailed sales information.

Compliance and Price Maintenance

Maintaining GSA pricing compliance is an ongoing responsibility:

Price Reduction Clause (PRC)

This clause requires you to maintain the negotiated relationship between your GSA prices and commercial prices throughout the contract. If you lower prices for your basis of award customer (typically your MFC), you may need to offer corresponding reductions to the government.

Basis of Award Customer Tracking

During negotiations, GSA will establish your ‘Basis of Award’ customer or category – the commercial customer(s) whose pricing relationship with you becomes the benchmark for your government pricing.

This may or may not be your Most Favored Customer. You must maintain the negotiated discount relationship between this customer category and your GSA pricing throughout the contract term. Any changes in commercial pricing that affect this relationship may trigger Price Reduction Clause obligations.

Contract Modifications

Any changes to your GSA pricing require formal modification requests. These include:

- Adding new products or services

- Implementing price increases (subject to EPA clause limitations)

- Offering temporary or permanent price reductions

- Updating labor categories or product specifications

Expert tip: Many pricing issues come from selling first and updating the contract later. Even small changes (e.g., new service tiers, updated labor categories, or adjusted pricing) should go through the modification process. Keeping the contract aligned with how you actually sell prevents confusion during audits.

Audit Risk

The GSA Office of Inspector General can audit your pricing practices to verify compliance with your contract terms. Non-compliance can result in significant penalties, including contract cancellation or False Claims Act liability.

Reporting Requirements

Depending on your contract, you’ll need to report your GSA sales quarterly and pay an Industrial Funding Fee (IFF) of 0.75% on those sales.

Staying compliant with these requirements demands vigilant contract management and thorough documentation of all pricing decisions.

GSA Pricing Documentation and Platforms

Required Documentation: When submitting your GSA pricing, you’ll need to provide:

- Commercial price lists or established catalog pricing

- Detailed discount structures for all customer categories

- Special pricing arrangements or exceptions

- Cost build-up information for certain products or services

- Supporting documentation for any requested exceptions

GSA eLibrary and GSA Advantage: Once approved, your GSA pricing will be published on:

- GSA eLibrary: The official online source for GSA contract award information, where agencies can view basic contract details

- GSA Advantage: The government’s online shopping platform where your detailed pricing, product descriptions, and service offerings will be displayed to potential federal buyers

Industrial Funding Fee (IFF): The standard 0.75% IFF is embedded in your GSA pricing. This fee funds the GSA Schedules program operations and must be included in your pricing calculations. You’ll remit this fee quarterly based on your reported sales.

GSA Pricing Strategy for Vendors

Developing an effective GSA pricing strategy involves several considerations:

- Competitive Analysis: Research what other Schedule holders charge for similar offerings. While you don’t want to undervalue your products or services, being significantly higher-priced than competitors can limit your success.

- Long-term Planning: Remember that your GSA contract can last up to 20 years. Structure your pricing to accommodate future cost increases, market changes, and business growth.

- Discount Strategy: Carefully consider what discount from your commercial pricing makes sense for the government market. Factors to consider include:

- Volume potential from government sales

- Reduced marketing costs for government business

- Different support requirements for government vs. commercial customers

- Competitive landscape in the federal space

- Pricing Flexibility: Build in mechanisms that allow you to adjust pricing as needed, such as appropriate EPA clauses or tiered volume discounts.

- Balance Between Services and Products: If you offer both, consider how they complement each other in your overall pricing strategy.

Road Map Consulting GSA Services

GSA pricing works best when it reflects how a business actually operates. When pricing rules match real sales behavior and costs, compliance becomes easier and pricing decisions feel less restrictive over time. – Michael Perch, CEO of Road Map Consulting.

Road Map Consulting specializes in simplifying the complex world of GSA pricing and compliance for businesses of all sizes. Our team of experts brings over 100 years of combined experience in federal contracting to help you navigate the GSA pricing process successfully.

Our comprehensive GSA services include: