What is GSA Compliance? (+ Checklist for 2025)

GSA compliance isn’t just a checkbox exercise. It’s the backbone of maintaining a trustworthy, legally sound relationship with the General Services Administration and, by extension, the entire federal marketplace.

In this guide, you’ll get a clear, practical overview of GSA compliance. We’ll walk through what it actually is, the key requirements you need to meet, how to verify your compliance status, and what happens if you fall short.

What is GSA Compliance?

GSA compliance refers to meeting all the rules, regulations, and contractual obligations established by the General Services Administration for contractors who hold a GSA Multiple Award Schedule (MAS) contract.

These requirements cover pricing policies, reporting obligations, documentation standards, and ethical practices that contractors must follow throughout the life of their contract.

- Contract validity: Non-compliance can lead to contract cancellation

- Business reputation: Violations can damage your standing with federal agencies

- Financial stability: Penalties for non-compliance can be substantial

- Competitive advantage: Compliant contractors gain more federal opportunities

- Risk management: Proper compliance reduces audit risks and potential legal issues

Think of GSA compliance as your ongoing commitment to play by the rules. It’s not a one-time hurdle you clear when you win a contract. Instead, it’s a continuous obligation that covers everything from pricing transparency and accurate reporting to ethical business practices and timely renewals.

Many contractors only start thinking seriously about compliance after something goes wrong. A late report, a pricing question on an awarded contract that violates the Price Reduction Clause, or an unexpected audit notice is often what brings compliance into focus. When compliance is treated as part of everyday operations from the start, it stops feeling like a risk and starts feeling manageable – Michael Perch, CEO of Road Map Consulting.

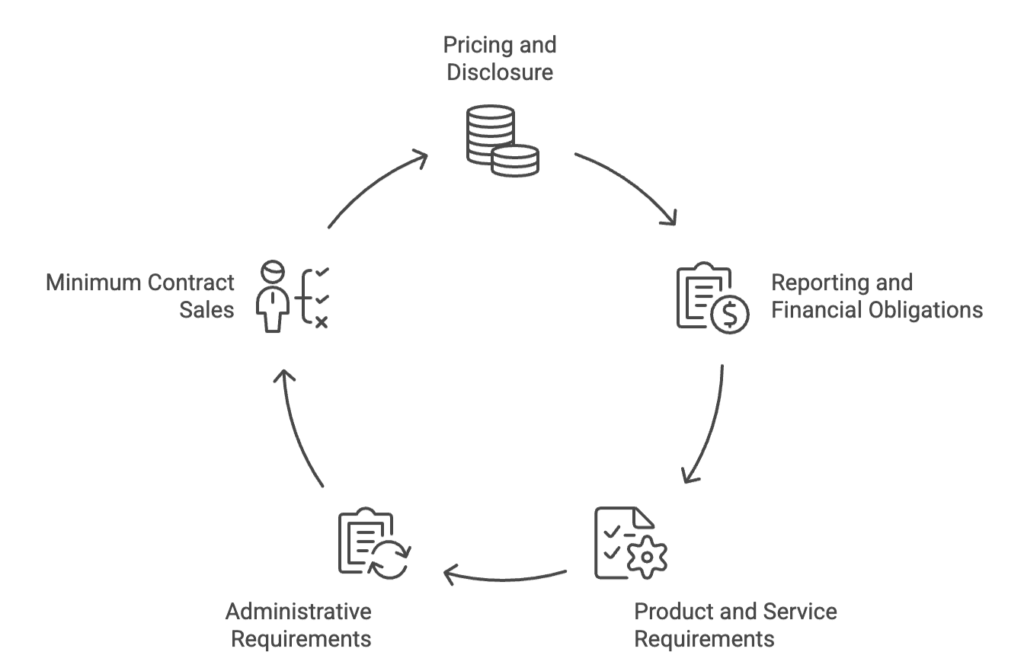

Key GSA Compliance Requirements

Let’s break down the most critical compliance areas that every GSA contractor needs to understand:

Pricing and Disclosure Requirements

The foundation of GSA compliance rests on transparent and fair pricing. When you applied for your GSA Schedule, you likely submitted Commercial Sales Practices (CSP) disclosures that revealed your pricing structure to commercial customers. The government uses this information to negotiate fair pricing.

Once your contract is awarded, you must maintain the pricing relationship established during negotiations. This means if you offer deeper discounts to your commercial “Basis of Award” customer than what was disclosed, you may need to extend similar discounts to the government under the Price Reduction Clause.

Key components include:

- Commercial Sales Practices (CSP) disclosure

- Price Reduction Clause (PRC) monitoring

- Most Favored Customer (MFC) pricing relationships

- Basis of Award customer tracking

Reporting and Financial Obligations

Every GSA contractor must report their contract sales quarterly through the FAS Sales Reporting Portal. Depending on your reporting type, this is done either quarterly (IFF-based, legacy) or monthly (for TDR contractors). These reports directly determine your Industrial Funding Fee (IFF) – currently 0.75% of all GSA MAS sales.

Missing reporting deadlines or underpaying the IFF can trigger compliance flags in the GSA system. Your accounting systems need to accurately track GSA sales separately from your commercial business. This separation is crucial not only for reporting but also for potential audits down the road.

- Industrial Funding Fee (IFF) payment (currently 0.75% of sales)

- Quarterly sales reporting through the FAS Sales Reporting Portal

- Accurate contract sales tracking systems

Product and Service Requirements

If you sell products through your GSA Schedule, you need to ensure they comply with the Trade Agreements Act (TAA). This means they must be manufactured or “substantially transformed” in the United States or designated countries. Products from non-designated countries like China are generally prohibited.

You’re also responsible for ensuring that what you deliver meets the specifications outlined in your contract. Quality, delivery timelines, and performance standards all matter. Cutting corners or delivering subpar work doesn’t just hurt your reputation, it can trigger contract violations.

- Trade Agreements Act (TAA) compliance for products

- Approved labor categories and qualifications for services

- Accurate product/service descriptions in all catalogs

Administrative Requirements

Maintaining an active registration in the System for Award Management (SAM.gov) is a fundamental requirement that’s easy to overlook. Your registration must be renewed annually, and any changes to your business information must be updated promptly.

You also need to submit contract modifications for any significant changes to your offerings, pricing, or company information. Selling products or services not properly added to your contract through the modification process is a compliance violation that can have serious consequences.

- System for Award Management (SAM.gov) registration

- Timely contract modifications

- Proper use of GSA logos and marketing practices

- Cybersecurity compliance (FISMA, CMMC where applicable)

- Socioeconomic reporting

Minimum Contract Sales Requirement

GSA requires every MAS contractor to meet a minimum level of contract performance. To keep your Schedule active, you must generate at least $100,000 in GSA MAS sales within the first five years and every five years thereafter. Falling below this threshold places your contract at risk of cancellation.

Key components include:

- Tracking MAS sales separately from commercial sales

- Monitoring progress toward the $100K requirement

- Documenting MAS revenue for IOA assessments

- Addressing low sales early through marketing or contract updates

GSA Compliance Checklist for 2025

Staying compliant means staying organized. Here’s a practical checklist to help you manage your GSA compliance obligations throughout the year:

| Stage | Compliance Requirement |

|---|---|

| Pre-Contract Compliance | Complete and maintain SAM.gov registration |

| Prepare accurate Commercial Sales Practices (CSP) disclosure | |

| Verify all products meet Trade Agreements Act (TAA) requirements | |

| Conduct internal pricing analysis to establish discount structure | |

| Develop compliant marketing materials and digital assets | |

| Establish systems to track GSA sales separately from commercial sales | |

| Identify Basis of Award customer(s) for Price Reduction Clause monitoring | |

| Post-Award Compliance | Submit accurate product and service data to GSA Advantage |

| Set quarterly or monthly TDR reminders for Industrial Funding Fee (IFF) payments | |

| Configure accounting systems to track GSA sales separately | |

| Train sales staff on GSA pricing requirements | |

| Update company website with GSA contract information | |

| Establish internal contract management responsibilities | |

| Create a documented contract modification request process | |

| Ongoing Contract Maintenance | Conduct quarterly reviews comparing commercial pricing vs. GSA pricing |

| Ensure Basis of Award customers are not receiving deeper discounts | |

| Submit a price reduction modification when required | |

| Perform internal audits of GSA sales at least annually | |

| Verify all products/services sold are awarded on your contract | |

| Confirm labor categories billed meet qualification requirements | |

| Ensure pricing matches awarded contract terms | |

| Maintain comprehensive GSA transaction records | |

| Retain quotes, POs, invoices, and delivery confirmations | |

| Store contract records for contract life + 3 years | |

| Submit contract modifications when needed | |

| Update pricing or discount structures | |

| Never sell unapproved items outside your awarded scope |

This checklist works best when it’s treated as a living document. Contractors that revisit these items throughout the year tend to catch issues early. Those that only review compliance at reporting time usually feel rushed and reactive.

How Do You Know if You’re GSA Compliant?

Good question, and one that government buyers, potential partners, and even you yourself should be asking regularly:

- Check your contract status

- First, check your contract status in GSA Advantage or eLibrary.

- If your contract is active and your information is up to date, that’s a positive sign.

- But being listed doesn’t automatically mean you’re fully compliant, it just means your contract hasn’t been flagged or suspended yet.

- Review your internal records

- Are you current on quarterly sales reporting?

- Have you submitted your IFF payments on time?

- Is your SAM registration active?

- Have you disclosed all required pricing changes?

- Are your modifications up to date?

- If you answered “no” or “I’m not sure” to any of these, it’s time to dig deeper.

- Conduct regular self-audits

- Create a compliance calendar that tracks reporting deadlines, contract anniversaries, SAM renewal dates, and any upcoming modification needs.

- Many contractors use compliance software or work with consultants to stay on top of these obligations.

- Pay attention to GSA correspondence

- If you receive a request for information, a notice of non-compliance, or an audit notification, don’t ignore it.

- Respond promptly and thoroughly.

- Silence or delays can escalate minor issues into major problems.

Uncertainty is often the first warning sign. If key questions can’t be answered quickly, that usually means systems or responsibilities aren’t clearly defined. Regular self-checks make it easier to spot gaps before they turn into formal compliance problems.

What Happens If You’re Not Compliant?

The consequences depend on the severity and nature of the violation. Minor issues, like a late sales report or a small documentation error, might result in a warning or a request to correct the problem. But even these seemingly small slip-ups can add up if they become a pattern.

- Financial penalties: Fines can range from thousands to millions of dollars depending on the violation

- Contract cancellation: GSA can terminate your contract for repeated or serious violations

- Payment suspension: The government may withhold payments until compliance issues are resolved

- Debarment: In severe cases, contractors can be prohibited from future federal contracting

- Legal action: The Department of Justice may pursue False Claims Act cases for pricing violations

- Reputational damage: Non-compliance can harm your standing with all federal agencies

The GSA Office of Inspector General (OIG) actively conducts pre-award, post-award, and claims audits to verify compliance. These audits can be triggered by various factors, including contract size, reported sales volume, or random selection.

Stay Ahead of GSA Compliance

GSA compliance isn’t something you achieve once and forget about. It requires ongoing attention and resources. The contractors who succeed in the federal marketplace are those who build compliance into their business processes.

Take a proactive approach by scheduling regular internal reviews rather than waiting for problems to surface. Many successful contractors conduct quarterly compliance checks that mirror what a GSA auditor might look for.

Stay informed about changing GSA regulations. The rules evolve over time, and what was compliant last year might not be this year. Industry associations, GSA webinars, and professional consultants can help you stay current.

Road Map Consulting GSA Services

At Road Map Consulting, we’ve guided hundreds of contractors through the complexities of GSA compliance since 2009. Our approach focuses on making compliance manageable and integrating it into your normal business operations.