GSA Eligibility: Who Qualifies and How to Apply

Securing a GSA Schedule contract opens doors to billions in federal procurement opportunities, but not every business qualifies. GSA eligibility isn’t automatic, and it’s not always straightforward. You’ll need to meet specific business, financial, and regulatory standards.

This guide breaks down everything you need to know about GSA eligibility, who qualifies, who doesn’t, and how to position your business for success in the federal marketplace

What Is GSA Eligibility?

GSA eligibility refers to the set of criteria your business must meet to obtain a GSA Schedule contract. Think of it as the federal government’s way of vetting vendors before allowing them access to streamlined procurement channels.

When you hold a GSA Schedule, government agencies can purchase your products or services without going through lengthy competitive bidding processes. That’s a huge advantage, but it also means GSA needs to ensure you’re reliable, compliant, and capable of delivering on your promises.

Eligibility isn’t just about having a registered business: GSA evaluates your financial health, operational history, pricing competitiveness, and compliance with federal regulations. They want to know you can handle government contracts, meet delivery timelines, and adhere to strict reporting and invoicing standards.

In short, GSA eligibility is your business’s ticket to the federal marketplace. Without it, you’re locked out of one of the largest purchasing systems in the world.

Who Is Eligible for a GSA Schedule?

GSA Schedule eligibility depends on several overlapping requirements. You can’t skip any of them, and each one plays a role in determining whether your application gets approved:

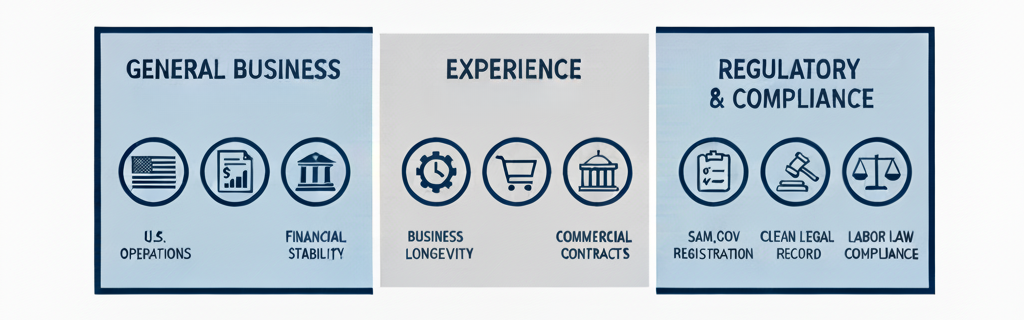

General Business Requirements

To qualify for a GSA Schedule contract, your business must meet several fundamental requirements:

- U.S.-Based Operations: Your company must either be incorporated in the United States or have a physical office location within U.S. territory.

- Financial Stability: The GSA requires at least two years of financial records demonstrating your company’s stability.

- Relevant Offerings: Your products or services must align with categories the GSA has designated for procurement. You can verify this by checking the GSA eLibrary to see if your offerings match existing Special Item Numbers (SINs).

- TAA Compliance: Products must comply with the Trade Agreements Act, meaning they must be manufactured or substantially transformed in the U.S. or a designated country. This requirement excludes products from certain countries, including China and Russia.

- Positive Past Performance: Your business should have a track record of satisfactory performance with existing customers.

“These requirements often show up in everyday scenarios. A company may have a great U.S. customer base, but if it doesn’t have a real U.S. office presence, eligibility becomes a problem. Another common one is TAA – businesses sometimes discover too late that a top-selling product line won’t qualify because of where it’s made.” – Michael Perch, CEO of Road Map Consulting.

Experience Requirements

GSA looks for businesses with established operations and proven capabilities:

- Business Longevity: Most businesses need at least two years of operational history. While exceptions exist for certain Special Item Numbers (SINs) or startups with exceptional past performance, this requirement helps ensure contractors have operational stability.

- Commercial Sales Track Record: You must demonstrate successful sales in the commercial marketplace before selling to the government. This requirement shows that your offerings have market validation and that you have experience fulfilling customer orders.

- Federal Contract Capability: While prior federal contracts aren’t strictly required, you must show the infrastructure, personnel, and processes to handle government contracts, which often involve complex compliance requirements.

The two-year rule is mostly about predictability. Newer businesses often change pricing, processes, and even offerings quickly. GSA wants to see that you’ve had enough time to operate consistently. For example, a startup may have a strong team and a good product, but if sales are still sporadic and pricing isn’t stable, it becomes harder to prove readiness. There are of course exceptions, and GSA recognizes this. That is why they have created the GSA SpringBoard for those startup firms that are mature in their pricing practice and models. – Michael Perch, CEO of Road Map Consulting.

Regulatory and Compliance Requirements

Several regulatory hurdles must be cleared:

- SAM.gov Registration: Your business must register in SAM.gov. This registration must remain active throughout the application process and contract period.

- Clean Legal Record: Your company cannot be debarred, suspended, or excluded from federal contracting. The government checks this status during the application review.

- Labor Law Compliance: Depending on your offerings, you may need to comply with the Service Contract Act, Davis-Bacon Act, or other labor regulations that govern wages and working conditions for federal contractors.

“SAM registration is one of those details that can quietly derail everything. It’s not unusual for a business to register once and forget to update it when something changes-an address update, a legal name detail, or NAICS codes. Those small mismatches can create delays later when the application is being reviewed.” – Michael Perch, CEO of Road Map Consulting.

Quick Look:

| Eligibility Category | Requirement |

|---|---|

| General Business |

|

| Experience Requirements |

|

| Regulatory Compliance |

|

List of Eligible Entities

GSA Schedule contracts are open to a variety of business types, not just large corporations. Here’s who can apply:

- Small businesses: This includes women-owned, veteran-owned, service-disabled veteran-owned, HUBZone, and 8(a) certified businesses. GSA actively encourages small business participation.

- Large businesses: Established companies with significant resources and market presence are also eligible.

- Nonprofit organizations: Certain nonprofits can qualify, especially if they provide services aligned with government needs.

- Educational institutions: Colleges, universities, and research institutions can apply for GSA Schedules related to their areas of expertise.

- State and local governments: In some cases, government entities can hold GSA Schedules to offer services to other agencies.

- Joint ventures and partnerships: If structured correctly and registered properly, joint ventures between eligible entities can apply.

Who Is Not Eligible for a GSA Schedule?

Not every business qualifies for a GSA Schedule. Common disqualifications include:

- Foreign Entities Without U.S. Presence: Companies without a physical U.S. location cannot obtain a GSA Schedule, even if they sell to U.S. customers. A distributor relationship or occasional business trips to the U.S. aren’t sufficient – you need an established office with staff working in the United States.

- Financially Unstable Companies: Businesses with poor credit, bankruptcy history, or inadequate financial resources may be deemed too risky. The government needs assurance that you’ll be in business throughout the contract period, which can last up to 20 years. Recent financial losses, excessive debt, or pending litigation can all raise red flags during the evaluation process.

- Non-TAA Compliant Suppliers: If your products come primarily from non-designated countries and cannot be substantially transformed in compliant countries, you won’t qualify. This is particularly challenging for businesses that source products from China or other non-designated countries. Simply repackaging or performing minor alterations to these products doesn’t constitute “substantial transformation” under TAA rules.

A common pattern is businesses applying too early because they’re excited about federal growth. But if the basics aren’t there, the application proposal becomes a time drain with little chance of approval.

Expert tip: In many cases, it’s more productive to spend six months building sales documentation and cleaning up sourcing than rushing into an application.

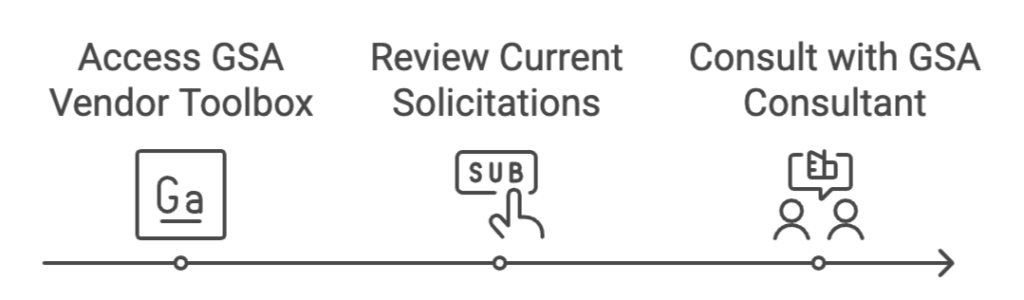

How to Verify Your GSA Eligibility

Before you invest time and money into a GSA Schedule application, it’s smart to verify your eligibility. Here’s how:

- GSA’s Vendor Toolbox: This online resource provides self-assessment tools to help determine if your business meets basic requirements. The Vendor Support Center offers guides, webinars, and checklists specifically designed to help potential contractors understand eligibility criteria. Take advantage of these free resources to conduct a preliminary assessment.

- Current Solicitations: Review active GSA solicitations on SAM.gov and eBuy to understand specific requirements for your industry category. Each solicitation contains detailed eligibility criteria that may vary slightly depending on the schedule and category. Pay special attention to any special requirements for your particular industry, as these can differ significantly between categories.

- Professional Consultation: GSA consultants can provide personalized eligibility assessments based on your specific business situation and offerings. An experienced consultant can identify potential issues before you invest significant resources in the application process.

GSA Schedule Eligibility for Small Businesses

Small businesses have a special place in the GSA Schedule program. The federal government is required to award a certain percentage of contracts to small businesses, and GSA actively supports small business participation.

- Small businesses with certifications such as 8(a), Woman-Owned Small Business (WOSB), Service-Disabled Veteran-Owned Small Business (SDVOSB), or HUBZone may receive additional consideration during the application process.

- Small businesses can also benefit from GSA’s Polaris system, which helps match your offerings with agency needs. You’ll have opportunities to participate in federal acquisition events, training programs, and networking sessions designed specifically for small contractors.

- If your small business doesn’t yet qualify for a prime GSA Schedule contract, you can gain experience by subcontracting with existing Schedule holders.

Product and Service Eligibility Criteria

Not all products and services qualify for GSA Schedules:

- GSA Categories: Your offerings must fit within established GSA categories such as Information Technology, Professional Services, Facilities, Security & Protection, Office Management, or Transportation & Logistics.

- Commercial Availability: Products and services must be commercially available and already sold to non-government customers at established market prices.

- Fair and Reasonable Pricing: Your pricing must be competitive and justifiable based on your commercial pricing practices and discounts.

- Country of Origin: Products must be manufactured or substantially transformed in the U.S. or designated countries per the Trade Agreements Act.

Preparing to Meet GSA Eligibility

Take these steps to position your business for GSA eligibility:

- Financial Preparation: Organize at least two years of financial statements and ensure your accounting systems can track government contracts separately from commercial work. The GSA will scrutinize your financial stability, so address any issues before applying. This might include improving your debt-to-income ratio, resolving tax issues, or strengthening your cash reserves.

- Catalog Assessment: Review your products and services against GSA categories using the GSA eLibrary to identify which items qualify and which SINs they fall under. Not everything you sell commercially will necessarily qualify for your GSA Schedule.

- SAM.gov Registration: Complete your registration in SAM.gov, ensuring all information is accurate and up-to-date, with appropriate NAICS codes that match your offerings. This registration is your business’s identity in the federal marketplace, so accuracy is crucial.

- Past Performance Documentation: Gather customer references, testimonials, and performance data that demonstrate your ability to deliver quality products or services consistently. The GSA will contact your references directly, so prepare them in advance.

Expert Tip: The strongest applications usually look boring -in a good way! Financials are organized. Sales history is easy to follow. Pricing has logic behind it. References are prepared. When everything is clean and consistent, reviewers have fewer reasons to pause or question readiness.

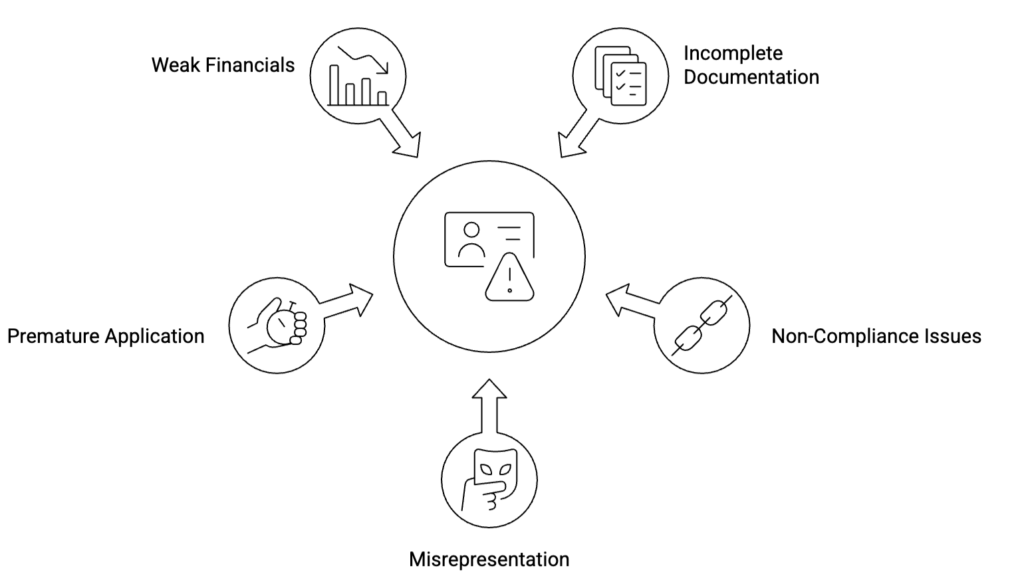

Common Mistakes That Lead to Ineligibility

Being ineligible doesn’t mean “never.” It usually means “not yet.” When businesses focus on building commercial proof, tightening financials, and cleaning up compliance basics, eligibility becomes a realistic goal instead of a guess.

Avoid these pitfalls that can derail your GSA Schedule application:

- Incomplete Documentation: Missing financial records, inadequate past performance information, or gaps in required certifications can result in rejection. The GSA application process is thorough and unforgiving of missing documentation.

- Non-Compliance Issues: Failing to meet TAA requirements or submitting pricing that doesn’t align with GSA’s fair and reasonable standards will disqualify your application. Many businesses don’t realize the extent of TAA restrictions until they’re deep in the application process.

- Misrepresentation: Overstating capabilities, experience, or past performance can lead to rejection and potentially more serious consequences. The government takes truthfulness in contracting very seriously, and misrepresentations can lead to not just application rejection but potential legal consequences.

- Premature Application: Applying before your business has sufficient operational history or commercial sales typically results in wasted effort and rejection. The GSA application process requires significant investment of time and resources. If your business doesn’t meet the basic eligibility requirements, it’s better to wait and build your qualifications rather than rushing into an application that’s likely to be rejected.

- Weak financials: GSA wants to see that you’re financially stable. If your financial statements show losses, inconsistent revenue, or high debt, you’ll struggle to qualify. Work with an accountant to present your finances in the best light.

What to Do If You’re Not Eligible Yet

If you discover that your business doesn’t meet GSA eligibility requirements right now, don’t give up. There are steps you can take to become eligible in the future.

- Build your sales history. Focus on growing your commercial client base. The more revenue and customers you can document, the stronger your application will be when you’re ready to apply.

- Improve your financials. Work with a financial advisor or accountant to strengthen your balance sheet. Pay down debt, increase cash reserves, and demonstrate consistent profitability.

- Achieve compliance. If your products or services don’t meet TAA or labor standards, make the necessary changes. Source TAA-compliant products, adjust your supply chain, or obtain the required certifications.

- Gain experience. If you’re new to government contracting, start with smaller opportunities. Register on SAM.gov, bid on state or local contracts, and build a portfolio of past performance.

- Get certified. If you qualify as a small business, pursue relevant certifications like woman-owned, veteran-owned, or 8(a). These designations can open doors and improve your eligibility profile.

- Consult with experts. A GSA consultant can assess your situation, identify gaps, and create a roadmap to eligibility. They can also help you understand timelines and prioritize the most impactful changes.

Is Your Business Ready for a GSA Schedule?

GSA eligibility is the gateway to federal contracting opportunities, but it’s not a quick fix or a shortcut. It requires a solid business foundation, financial stability, regulatory compliance, and a proven track record.

Before you apply, submit a proposal, take an honest look at where your business stands. Do you meet the basic requirements? Can you demonstrate commercial success? Are your products and services compliant with federal standards? If the answer to any of these is no, focus on building those areas first.

If you’re ready, the GSA Schedule can open doors to long-term, high-value contracts with federal agencies. It’s a competitive advantage that can transform your business and provide steady revenue for years to come.

Many companies turn to third-party support to navigate this complex journey. Road Map’s GSA consulting services are specifically designed to help businesses assess their current status, prepare documentation, and ensure they meet all federal expectations.

The investment in proper preparation pays dividends through a smoother application process and stronger positioning in the federal marketplace once approved. Many successful contractors report that the discipline required to meet GSA standards ultimately strengthened their overall business operations, benefiting both government and commercial work.

Key Takeaways

- GSA eligibility requires meeting specific business, financial, and regulatory standards to access federal procurement opportunities worth billions of dollars.

- Your business must have at least two years of commercial sales history, active SAM registration, financial stability, and compliance with Trade Agreements Act (TAA) requirements.

- Small businesses, including women-owned, veteran-owned, and 8(a) certified companies, receive additional support and set-aside opportunities in the GSA Schedule program.

- Common disqualifiers include lack of commercial sales history, TAA non-compliance, debarment or suspension records, and poor financial health.

- Before applying, verify your GSA eligibility by reviewing your SAM registration, assessing compliance with federal regulations, and consulting with GSA’s Industry Support team or a professional consultant.

Frequently Asked Questions

What are the basic requirements for GSA eligibility?

To qualify for GSA eligibility, your business must be a legal U.S. entity with SAM registration and FEIN, demonstrate financial stability with commercial sales history, have at least two years of relevant business experience, and maintain compliance with federal regulations including TAA and labor laws.

How do I verify my GSA eligibility before applying?

Start by ensuring your SAM.gov registration is current and complete. Review the GSA eLibrary for schedule-specific requirements, assess your compliance with TAA and labor standards, check your financial statements, and gather past performance records. You can also request an eligibility determination from a GSA Contracting Officer.

Are small businesses eligible for GSA Schedule contracts?

Yes, small businesses are eligible and actively encouraged to participate in the GSA Schedule program. Certified small businesses, including woman-owned, veteran-owned, and 8(a) firms, receive additional set-asides and preference programs, though they must still meet all standard GSA eligibility requirements.

How long does it take to become GSA eligible after registration?

GSA eligibility isn’t automatic after registration. The application proposal review process typically takes several months, depending on your documentation completeness and complexity. If you’re currently ineligible, building commercial sales history and achieving compliance may take 1-2 years before you’re ready to apply submit a proposal successfully.